Lease’T’Own® offers many advantages for both the dealer and the customer. The benefit we’ll touch on today is the Sales Tax benefit. There are also Income Tax benefits but we’ll address that topic in another article.

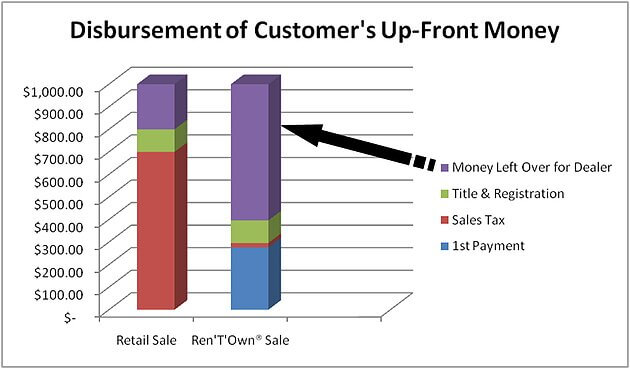

In a Retail car sale, the customer has to pay Sales Tax for the entire financed amount of the car up-front. This takes a huge chunk of their available up-front money and leaves very little to cover your dealership’s expenses and leaves nothing for a profit. There isn’t a business out there, that I know of at least, that works for free or for a loss, so as a result, dealers are forced to require more up-front money from the customers. This added burden on the customer eliminates many potential customers from even coming to your dealership because they don’t have enough up-front money to do the deal. It’s a vicious circle.

With Lease’T’Own®, in most States, the sales tax is paid with each periodic payment so this means less of the customer’s up-front money is used for taxes and more can be used to cover the dealerships expenses and profit margin. With Lease’T’Own®, you are able to set a reasonable up-front requirement that the customer can meet and you are able to make a deal! It’s a Win-Win scenario further proving you as the HERO in the Community!