The newest addition to the arsenal of programs and products that help dealers succeed is the “Deal Protector” – a physical damage protection program for your customers.

CUSTOMER BENEFITS

In many cases, insurance rates are determined by the customer’s credit score and/or driving record. As a result, the premiums tend to be on the high side for the sub-prime customers leaving very little money for their upfront fees.

With the Deal Protector, on average, your customers will save between $25 – $300 on their physical damage insurance. How is this possible? Your customer’s driving record and credit scores aren’t checked! Premiums are based on the value of the car instead.

CONVENIENCE

You can offer your customer this program right at your dealership! No one has to leave your dealership or wait for an agent to get back to you. Through an on-line program, you can sign up your customer for coverage in less than 5 minutes.

DEALERSHIP BENEFITS

With the lower insurance premiums, the customer will have more money available for up front fees.

This policy covers BOTH you and the customer but claims are paid to YOU! There’s no need to worry about the customer not cooperating with the insurance company or receiving the payment in error. YOU get to file the claim and YOU get paid by the insurance company for the damage.

You will always know the status of the physical damage insurance policy because you control when coverage is put on or removed through the on-line program. The insurance company bills you each month and you collect the premium from the customer along with their lease payment.

We recommend using the SILVER level excess contingent liability insurance coverage when your customer has purchased the Deal Protector. The SILVER level provides you with $1,000,000.00 (One million dollars) or excess contingent liability insurance coverage at a rate of $4.95 per car, per month.

HOW IT WORKS

Because the insurance rates are based on the value of the car, you will want to figure the insurance rates on your vehicles ahead of time so you’ll be able to present the option to your customer.

Here is how we recommend that you value the car and determine the insurance premium.

STEP 1

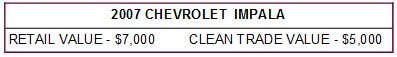

Using the NADA book value, determine the Retail and Clear Trade Value of the vehicle.

STEP 2

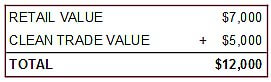

Add the two Values together

STEP 3

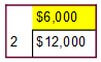

Divide the total by 2

STEP 4

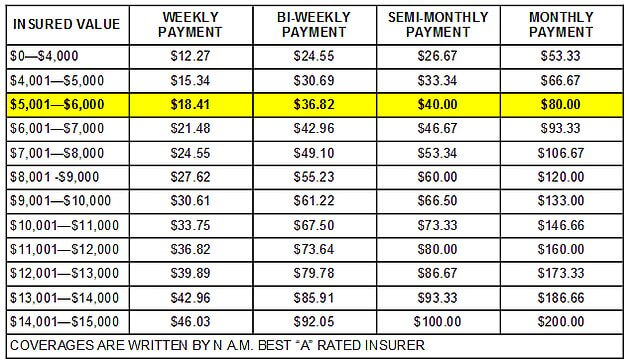

Using the insurance value you found in Step 3 ($6,000) and the customer’s lease payment frequency, find the rate to charge your customer on the chart below:

The insurance company will bill you at the end of each month for 1 month’s premium per car. We suggest that you collect 2 months premium from the customer upfront. That gives you an extra month’s premium in case the customer fails to make their payment. This will give you time to get the vehicle back and maintain insurance coverage without it being an out of pocket expense to you.

The customer must be given a choice if they want to buy the insurance from you or from another insurance company. We provide an addendum form for the customer to sign acknowledging that they chose this insurance.

Remember that the customer MUST obtain liability insurance. They can obtain this insurance from any company they wish. There are no excluded companies for this liability coverage.

ADD UP THE SOLUTIONS

1. Lower insurance rates for the customer

2. Much lower excess contingent liability monthly costs per vehicle for you

3. Direct payment of vehicle claims to you

4. Bind the physical damage coverage quickly and directly through your dealership.