We talked about the Sales Tax benefits of Lease’T’Own® in an earlier article and now we’d like to touch on Income Tax.

For a Buy-Here-Pay-Here Dealer, you are required to pay taxes on the profit you made on each vehicle sale at the end of the year in which you sold the vehicle. In other words, you pay taxes on the difference between what you paid for the vehicle vs. the sale amount.

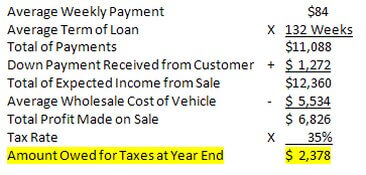

Using the industry averages, let’s walk through an example of this.

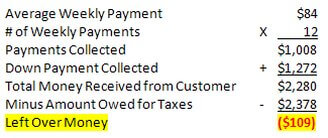

Now let’s say that you made this deal in October so your customer has only 12 payments until the end of the year.

You haven’t even collected enough money from the customer yet to cover what you owe in taxes! To make matters worse, if you have to repossess the vehicle during the year (which on average is over 30% of the vehicles) and aren’t collecting payments from the customer anymore, the full amount of taxes are still due!

With Lease’T’Own® your profit is figured on each payment. You pay income tax only on the income you’ve received. This relieves you of the tax burden at the end of the first year and allows you stretch your cash throughout the term of the lease. Also, if the car is returned to you, no further income tax is paid. This is clearly a benefit to your bottom line and allows for better cash flow throughout the year.

Another benefit to consider – you own the car throughout the term of the lease so you can depreciate it.

Be sure to give us a call at 800-879-3433 if you have any questions about these tax benefits or if you have any other question about Lease’T’Own® in general.

Disclaimer: We are neither lawyers nor certified public accountants. Please check with your lawyer, certified public accountant and authorities in your state for appropriate and accurate information for proper compliance.